Introduction

The assessment of the long-term fiscal position of the United States by Harvard’s Martin Feldstein in 1997 can be applied to most of the developed world today. The ‘pay-as-you-go’ comprehensive social security system that became popular during the early period of the Keynesian Consensus supporting retirement income and healthcare is already unsustainable. Unfortunately, because of the inevitable trend of population ageing, long-term unfunded liabilities – financial obligations from governments to citizens with insufficient funds to cover future projected costs – states will be required to spend far more on healthcare and pension (Goodhart and Pradhan, 2020). In response, various governments pursued a myriad of policy options – and failed so far – to tackle this inevitable trend, including tweaks in the system including increasing the retirement age, indexation of pension and in some cases compulsory private savings towards self-provision.

The crucial question is how to accomplish and resolve this looming problem. Some suggest imposing significant tax increases – such as capital and wealth taxes favoured by the left – or cutting expenditures to an extent that undermines the poorest members of our society without an alternative safety net – which is the libertarian argument. The former option supported by the Green Party will push capital out of the nation, undermine our economy, and at best raise barely any revenue. The latter commonly from the ACT Party does not provide any alternative solutions beyond the status quo. Sentimental push from economists towards “faster productivity growth” is not a solution either (Wilkinson, 2024). In my view, there is no alternative but to prioritise raising domestic savings in New Zealand (NZ) towards supporting economic development. New unorthodox thinking and economic approach is required to resolve the challenges facing New Zealand, beyond the left-right political divide.

Reddell’s article – Is compulsory saving the answer?

In response to the relatively interesting – but flawed – analysis by economist Michael Reddell (2025), this essay seeks to counter the arguments provided on the topic of savings. These were the following main arguments and points from Reddell’s article:

- Economic growth has been stagnant and some analysts – including Leonard Hong – have argued for higher domestic savings and Reddell questions their conclusions.

- Compulsory savings have not led to significant productivity gains and believes other variables are more important to economic success.

- Reddell argues that Australia’s spending on retirement income is still relatively high for the old age pension – which is means-tested – and national savings has not risen to the extent he anticipated and productivity is nowhere near the level of the United States.

- Singapore’s national savings did not play as much of a major role in the city-states’ substantial part in their economic success, but rather more from its global competitiveness and low tax settings.

- The role of foreign capital and domestic capital on economic growth is still under debate, and Professor Robert MacCulloch’s argument on the “Feldstein-Horioka puzzle” is interesting, but not entirely convincing.

- Savings rates are often a response to investment opportunities rather than a cause; therefore, Reddell questions the notion that low domestic savings constrain investment in countries like New Zealand.

I broadly support the idea of mandatory savings – mainly because of its pragmatism and simplicity but also the positive spillover effects as outlined from my previous academic work examining Singapore’s economic model centred around the development of public assets (Hong, 2024). Furthermore, numerically higher domestic savings increase the capital available for investment, which translates to investment in infrastructure, businesses, and innovation, and therefore higher productivity. Other scholars provided potential and feasible alternatives based on mandatory savings across various nations such as Singapore, Chile, Sweden, and Australia (Feldstein, 1998; Kotlikoff and Burns, 2004; Ferguson, 2008; Micklethwait and Wooldridge, 2014; Chia, 2016; Douglas and MacCulloch, 2018).

These are the main reasons why I have repeatedly called for a bipartisan political approach to public asset development, in the form of both supporting our KiwiSaver and our sovereign wealth fund, the NZ Superannuation Fund (NZ SuperFund). New alternative state investment vehicles in the form of institutions such as the Accident Compensation Corporation have also provided social and economic benefit to the NZ public. In contrary to Reddell – and others – I will argue that higher domestic savings, supported by a structured compulsory savings system, is essential for New Zealand’s long-term economic prosperity.

Productivity and the Role of Domestic Savings?

The productivity puzzle in NZ has been widely examined across society. Former NZ Prime Minister John Key suggested the cause of our productivity woes was our “geography” – which is in line with Jared Diamond’s (1997) argument on what mainly distinguishes rich and poor countries. Other scholars including Nobel laureates Acemoglu and Robinson (2012) highlighted the quality of political and economic “institutions”. Huntington and Harrison (2000) provided a cultural perspective on economic development and productivity, especially on aspects of work ethic, meritocracy and openness to innovation. I broadly agree with all these theories – especially the institutional argument – but the point is that the debate on what improves productivity has always a puzzle for scholars and policymakers. I am strongly convinced that higher domestic savings – complemented by overseas investment – boosts economic growth and productivity.

Australia’s Productivity

Reddell mentions that Australia’s compulsory superannuation systems set up by Paul Keating has not led to higher net national savings as anticipated despite the policy mandating private savings for retirement on the public. To his credit, it is true that savings have not been as high, but this is attributed to the ‘substitution’ incentive for Australians to borrow more money under the assumption their wealth will accumulate through their superannuation (Connolly and Kohler, 2004). This was previously examined by many behavioural economists such as Daniel Kahneman (2011) on the ‘present and status quo biases.’ However, by in large, academic studies in Australia show that compulsory superannuation still led to increases in net savings broadly (Ruthbah and Pham, 2020).

Despite the relatively mediocre net savings, Reddell points out that Australia is much wealthier than NZ with a much higher GDP per capita of around USD$20,000 stating, “Australia is, by the way, the most culturally and behaviourally similar country to New Zealand in the world.” (Isn’t the fact that the author of this essay is working in Australia somewhat ironic?). His comparison between Australia and the United States may not fully account for the unique factors that influence their economies, such as the role of the US dollar as the world’s reserve currency. Furthermore, if the United States government followed Martin Feldstein’s advice of “large-scale compulsory saving”, perhaps they would not be in such a dire fiscal situation of US$37 trillion of net government debt – culminated from the unnecessary and costly wars in the Middle East.

In relation to the comparisons with NZ, there are two major variables in my view that distinguish the two countries – iron ore and the superannuation funds sector. The former, we have limited control over – although depending on the agenda of NZ Resources Minister Shane Jones – but the latter, there is greater potential for reform.

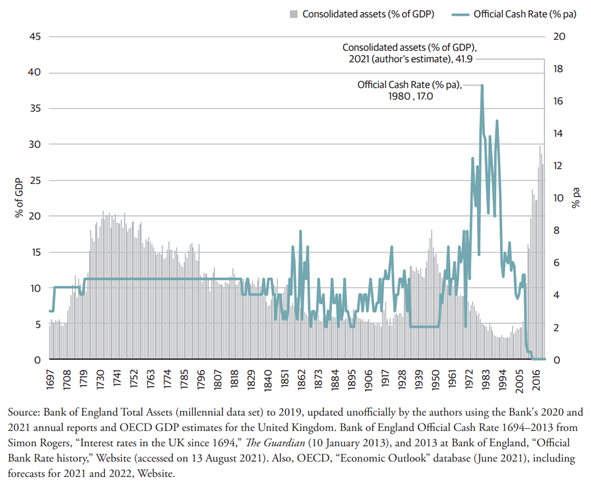

Figure 1: Capital Intensity, 1972 to 2015

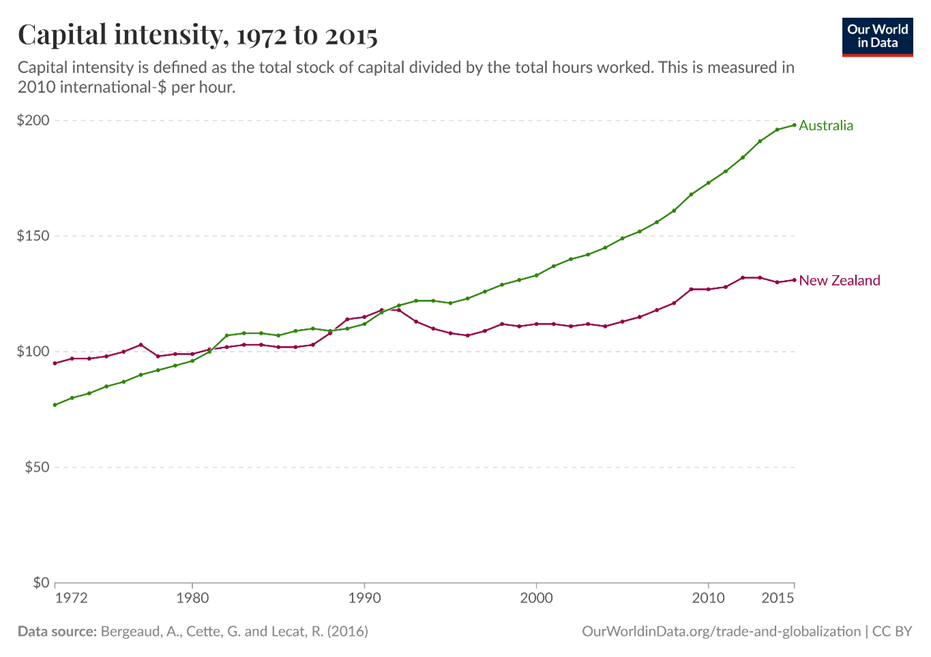

The superannuation system now manages more than AUD$4.1 trillion under management which is the fourth largest savings pool in the world which comprises of 150% of Australia’s GDP – which is expected to become the second largest savings pool by 2050. This is remarkable for the 55th largest nation in the world. This pool of capital translated to rapid increases in capital intensity for the Australian economy. As shown in Figure 1, from World in Data, the specific critical juncture was from 1991, which was when Australian Prime Minister Paul Keating decided to introduce Compulsory Superannuation to “to reduce the future reliance on the age pension, and over time, give ordinary people a better retirement.” (Keating, 2013). He had the foresight and prescience to understand that demographic pressure was inevitable. Therefore, setting up a mandatory savings scheme would allow the system to transfer more from a ‘pay-as-you-go’ system towards a ‘self-provision’ based system. To Keating’s credit, the call on the budget from the old age pension dropped from 5% of GDP in 1991 down to around 1% in 2023. Secondly, in stark contrast to NZ, Australia recently had some periods of current account surpluses starting in 2019 without needing the begging bowl to foreign investors being capital poor. However, as shown by Figure 2, there is not much difference between Australia and NZ with both countries, and I concede that this is probably the weakest point of comparison in my analysis. The differences in economic scale, trade composition, and external sector dynamics significantly influence their respective balance of payments. Although I do consider the historical hypotheticals if Keating’s original plan of raising the compulsory savings rate beyond the 9.5% to 15% was actualised, especially given that Coalition governments have frequently prioritised tax cuts over further superannuation expansion (the Morrison government did eventually raise it to 12%).

Figure 2: Australia vs NZ – Balance of Payments in Proportion to GDP, 1989 to 2023 (World Bank Data)

I am not arguing that in the short-run a current account surplus or deficit is inherently good or bad – in the long run possibly – but it is clear that Keating’s policies led to the structural transformation of Australia’s economy. Despite later Coalition governments pursuing tax cuts over further superannuation expansion, much of the accumulated savings under Keating’s framework were directed toward domestic investment, funding major infrastructure projects such as the Port of Melbourne and Transurban Toll Roads. For higher productivity focusing on capital markets, NZ can only grow by boosting both domestic savings and allowing more foreign capital into the country which will consist of cutting actual red-tape to FDI through supply-side reforms – which Reddell strongly agrees with me – and ramping up domestic savings through KiwiSaver – or other private saving investment vehicles (MacCulloch, 2024). The current National Coalition government’s emphasis has been on attracting overseas investment whilst broadly ignoring the problem of domestic savings so far.

Singapore’s Productivity

Reddell rightly praises Singapore’s economic miracle with the city-state having one of the highest per capita GDP in the world. However, he claimed that “it would be very hard indeed to argue that national savings played any very substantial part in Singapore’s economic emergence.” I believe this perspective overlooks a critical component of Singapore’s economic strategy, which was deeply rooted in their national savings system as a fundamental part of economic policy for current Singaporean politicians (Lee, 2024). Whilst the Central Provident Fund (CPF) was set up in the 1950s, it was an inherent part of the Singapore government’s fiscal strategy. Lee Kuan Yew (2000, p.97) stated he not only maintained the compulsory nature of the system but regularly raised the contribution rates to “avoid placing the burden of the present generation’s welfare costs onto the next generation.” Furthermore, according to Lee (2000, p.102-103), the critical aspect is to ensure bare minimum fiscal pressure on the state to avoid the ‘buffet syndrome’, a fact which Reddell omitted when publishing his article:

Through the CPF system, Singaporeans have access to a comprehensive self-financing social security fund comparable to any old-age pension system or entitlement system in the Western world without transferring the burden to the next generation of workers (Micklethwait and Wooldridge, 2014; Chia, 2016; Douglas and MacCulloch, 2018). The Singaporean government understood the importance that every generation should contribute to their own pension and every individual should save for their own without burdening the state. CPF has a major role on Singapore’s economy – Reddell is incorrect. The whole entire purpose was fiscal discipline which is important for long-term economic growth and macroeconomic stability (Reinhart and Rogoff, 2009).

Secondly, Reddell cites comprehensive data concerning Singapore’s current account position and national savings record in proportion of GDP from the International Monetary Fund. The question from him was the notion that the Singapore government relied on current account deficits in the early period of the 1970s and 1980s for its growth. Indeed, it is true and there is a specific reason. The East Asian Miracle – particularly in Singapore – shows that savings and investment are not separate, but interconnected variables in driving economic development.

Reddell should have considered the extensive work by development economists on the East Asian Miracle, where the initial phase of development focused on attracting foreign capital to acquire the necessary talent, business expertise, and technological spillovers that enabled these countries to build their own capabilities in the long run. This approach, championed by various economists that studied the East Asian developmental state model (Stiglitz, 1996; Chang, 2003; Rodrik, 2015; Haggard, 2018). While these nations initially relied on foreign investment, they eventually became capital-exporting economies after reaching a certain level of development and establishing competitive domestic companies and ‘national champions’. High domestic savings were critical in fostering capital formation for the Four Asian Tigers, which, in turn, led to productive investment and long-term growth.

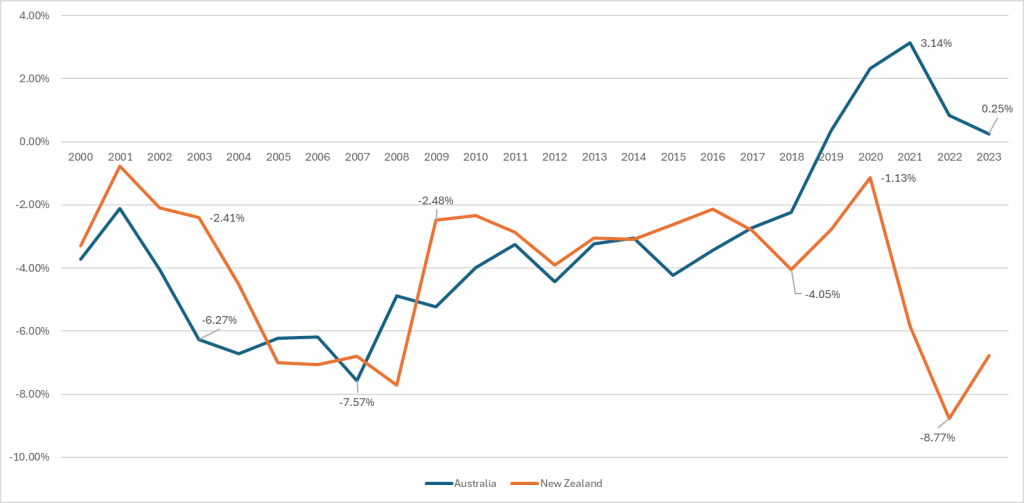

Figure 3: Singapore Government’s NIRC and Budget Deficits/Surpluses (S$ Millions)

Furthermore, Reddell didn’t mention the importance of sovereign wealth funds for Singapore, but it is relevant to the argument in this essay – it was covered extensively across my postgraduate dissertation. Singapore relies heavily on endowment funds provided by the Government Investment Corporation (GIC) and Temasek Holdings, called Net Investment Returns Contribution (NIRC). For example, in the 2024 Budget, the Singapore government received S$23 billion through the NIRC, comprising 18% of the revenue – 3.4% of GDP. This fiscal mechanism has many benefits since it allows the state to be ‘developmental’ such as public investments in infrastructure, housing, and education, but also tax breaks for new start-ups, capital allowance on depreciable assets, 250% tax deduction on R&D expenses, low corporate tax rate of 17%. The pro-business settings – including tax breaks that Reddell gives a fair bit of credit to Singapore – was possible because of their net zero debt position with massive amount of financial assets – worth US$1.9 trillion owned by the public. As shown in Figure 3 – which is from my dissertation – seven of the ten last government budgets saw the NIRC contribute an overall surplus, despite eight budgets having a primary structural deficit.

Conclusion

In conclusion, I disagree with the premise of the article that was published by Michael Reddell. I fully support Martin Feldstein’s remarks from 1997 that the “obvious solution is to shift to a privatised system of pre-funding those benefits through mandatory contributions to individual accounts.” I do not see another alternative policy approach to tackle this looming macroeconomic problem. The mainstream economic approach currently tinkers around the edges. The status quo – even with the NZ SuperFund – will be fiscally inadequate as highlighted by the NZ Treasury’s Long Term Fiscal Position forecasts. I suggest that moving to a hybrid system like Australia with a means-tested old-age pension would be the next step by incrementally raising the minimum contribution rates to KiwiSaver – either employee or employer – as highlighted by the Retirement Commission (Katz, 2024). Andrew Coleman (2024) recently highlighted the major issue of designing the new system towards “intergenerational neutrality” without harming the younger generation to continue to pay for retirees and at the same time build a nest-egg for their future. This major issue of intergenerational fairness is a very tricky and puzzling problem for transitioning from our current ‘pay-as-you-go’ system towards a social security system based on ‘self-provision.’

Both examples of Australia and Singapore show that high domestic savings matter to a large extent on both macroeconomic stability and economic performance. I also do not see ‘domestic savings’ in a similar way to Reddell that “savings themselves are endogenous.” Savings are not entirely endogenous but can be nudged and supported through policies that incentivise individuals and households towards more private savings and investment. The fact is that NZ has one of the lowest domestic household savings across the developed world is worrisome. Therefore, reversing the trend is critical, not only for our long-term fiscal position but also our economic prospects in the future. We should be attempting to emulate parts of what Australia and Singapore have done, instead of labelling such policy proposals as ‘paternalistic’ or ‘authoritarian’.

Reddell’s statement that “retirement income policy should be approached on its own terms, with a focus on individuals and their own ability to manage retirement,” is a simple classically liberal philosophical position. The only difference from my end is suggesting that people mandatorily save rather than forcefully pay high tax rates! The state already compels the public to pay income tax, and GST, so what is the difference between taxes and being compelled to save money? A high return on private savings is achieved by investing in high-performing investments with compound interest, whereas taxes are simply a means of generating revenue for the state.

NZ is currently discussing the importance of attracting more foreign direct investment. I broadly agree that we need to make it easier for capital from overseas to invest into NZ equities, companies, land, industrial development, housing supply and our chronic infrastructure deficits highlighted by the Infrastructure Commission. However, there is a limit to this strategy as higher concentration of foreign capital also risks financial instability and tends to lead to slower growth than countries that have higher proportion of domestic savings (Prasad et al, 2007; Cavallo et al, 2016). And this idea was partially supported by Reddell who concluded in the latter part of his article stating:

Indeed, higher domestic savings by-in-large would have a positive effect on the current account, put less demand on the NZ dollar, support more exports and allow more Kiwis to accumulate foreign reserves and become a capital exporting nation.

The notion of having more savings on an individual and household level makes sense as a financial buffer and social insurance during times of personal difficulty. The prudent decision is to limit credit card debt and refrain from buying unnecessary items or making “vanity” purchases of luxury goods with credit cards. If every Kiwi behaved and understood finance like Warren Buffett and Charlie Munger, then we would not be having these policy discussions. Unfortunately, most of the NZ public do not have the appetite let alone the long term orientation or foresight to consider making sound financial decisions. If we apply this logic on a macroeconomic level, most of the readers will be able to comprehend as to why a lot of people – including myself – are advocating for mandatory savings. Former NZ Commerce Minister Andrew Bayly was pursuing important policies to kickstart financial education across our school system and I hope new Minister Scott Simpson completes the job. The average balance of NZ$38,000 for KiwiSaver is utterly woeful and nowhere enough to save for retirement – let alone purchasing a house.

I decided to respond in a comprehensive manner with this essay because Reddell is one of the most well-known economic commentators and analysts in NZ, and I have tremendous respect for his work. His compelling research with Dr Don Brash and Dr Bryce Wilkinson for the 2025 Taskforce was very useful with insightful economic suggestions. Anyone interested in economic policy should have a read – as well as his excellent blog. The debate regarding domestic savings is a necessary one, but I am confident that history will prove people such as myself to be correct in the long run.

NZ stands at a crossroads. Our low domestic savings rate, combined with an ageing population, poses a long-term fiscal challenge that cannot be ignored. Some may argue that foreign capital broadly can drive investment, but the examples of Australia and Singapore demonstrate that a comprehensive mandatory savings system not only strengthens financial stability but also boosts productivity and national resilience. In my humble opinion, there is no economic policy alternative to addressing the long-term fiscal debt problem, economic growth and productivity problems besides developing more public assets and boosting domestic savings through policies that support schemes such as KiwiSaver and the NZ SuperFund.

References

Acemoglu, Daron., & Robinson, James. (2012). Why Nations Fail: The Origins of Power, Prosperity, and Poverty. New York: Crown Publishing Group.

Cavallo, Eduardo., Eichengreen, Barry., & Panizza, Ugo. (2016). “Can Countries Rely on Foreign Saving for Investment and Economic Development?” IDB Working Paper No. IDB-WP-718. Retrieved from https://ssrn.com/abstract=2956698

Chang, Ha-Joon. (2003) Kicking Away the Ladder: Development Strategy in Historical Perspective. London: Anthem Press.

Chia, Ngee-Choon. (2016). Singapore Chronicles – Central Provident Fund. Singapore. Straits Time Press.

Coleman, Andrew. (2024). “Andrew Coleman calls for New Zealanders to focus tax policy attention onto the retirement income system, which he describes as the most unusual in the world.” Interest.co.nz. Retrieved from https://www.interest.co.nz/public-policy/129892/andrew-coleman-calls-new-zealanders-focus-tax-policy-attention-retirement

Connolly, Ellis., & Kohler, Marion. (2004). “The Impact of Superannuation of Household Saving.” Reserve Bank of Australia. Retrieved from https://www.rba.gov.au/publications/rdp/2004/pdf/rdp2004-01.pdf

Diamond, Jared. (1997). Guns, Germs, and Steel: The Fates of Human Societies. New York: W. W. Norton.

Douglas, Roger., & MacCulloch, Robert. (2018). Welfare: Savings not Taxation. Cato Journal 38(1): 17-34.

Feldstein, Martin. (1997). “The Case for Privatization.” Foreign Affairs. Retrieved from https://www.foreignaffairs.com/articles/united-states/1997-07-01/case-privatization

Feldstein, Martin. (Ed.). (1998). Privatizing Social Security. Chicago: The University of Chicago Press.

Ferguson, Niall. (2008). The Ascent of Money: A Financial History of the World. London: The Penguin Press.

Goodhart, Charles., & Pradhan, Manoj. (2020). The Great Demographic Reversal: Ageing Societies, Waning Inequality and an Inflation Revival. London: Palgrave Macmillan.

Haggard, Stephen. (2018). Developmental States: Elements in the Politics of Development. New York: Cambridge University Press.

Harrison, Lawrence., & Huntington, Samuel. (Ed.). (2000). Culture Matters: How Values Shape Human Societies. New York: Basic Books.

Hong, Leonard. (2024). “Lessons from Singapore on getting the Government’s books in shape without paying more tax.” The New Zealand Herald.

Hong, Leonard. (2024). “Savings and Sovereignty: Comparative Political Economy on Fiscal Discipline and Public Asset Management between Singapore and New Zealand.” Postgraduate Dissertation for NTU.

Kahneman, Daniel. (2011). Thinking, Fast and Slow. New York: Farrar, Straus and Giroux.

Katz, Adrian. (2024). “Lessons from across the Tasman: Comparing the Australian and New Zealand retirement income systems.” NZIER Working paper 2024/01. Retrieved from https://www.nzier.org.nz/publications/lessons-from-across-thetasman-comparing-the-australian-and-new-zealand-retirement-income-systems-nzierworking-paper-2024-01

Keating, Paul. (2013). “Where did SMSFs come from, and where are they going?”, Cuffelinks Newsletter. Retrieved from https://www.firstlinks.com.au/keatings-plans-superannuation-imputation

Kotlikoff, Laurence., & Burns, Scott. (2004). The Coming Generational Storm: What You Need to Know about America’s Economic Future. Cambridge: MIT Press.

Lee, Hsien Loong. (2024). “Transcript of speech by Prime Minister Lee Hsien Loong at the Debate on the Motion on Public Finances on 7 February 2024.” Prime Minister’s Office of Singapore. Retrieved from https://www.pmo.gov.sg/Newsroom/PM-Lee-Hsien-Loong-at-the-Debate-on-the-Motion-on-Public-Finances

Lee, Kuan Yew. (2000). From Third World to First—the Singapore Story: 1965–2000. Singapore: Singapore Press Holdings.

MacCulloch, Robert. (2024). “New Zealand doesn’t have a problem with productivity – it just lacks investment. The economic “experts” have got it wrong for 40 years.” Down to Earth Kiwi Blog. Retrieved from https://www.downtoearth.kiwi/post/nz-doesn-t-have-a-problem-with-productivity-it-just-lacks-investment-the-economic-experts-have

Micklethwait, John., & Wooldridge, Adrian. (2014). The Fourth Revolution: The Global Race to Reinvent the State. London: Penguin UK.

Prasad, Eswar., Rajan, Raghuram, & Subramanian, Arvind. (2007). “Foreign Capital and Economic Growth.” Brookings Papers on Economic Activity, 2007 (1), 153–209. Retrieved from http://www.jstor.org/stable/27561577

Reddell, Michael. (2025). “Is compulsory saving the answer?” Croaking Cassandra. Retrieved from https://croakingcassandra.com/2025/02/26/is-compulsory-saving-the-answer/

Reinhart, Carmen., & Rogoff, Kenneth. (2009). This Time Is Different: Eight Centuries of Financial Folly. New Jersey: Princeton University Press.

Rodrik, Dani. (2015). Economics Rules: The Rights and Wrongs of The Dismal Science. New York: W.W. Norton.

Ruthbah, Ummul., & Pham, Nga. (2020). “Household Savings and the Superannuation Guarantee.” Commonwealth Treasury & Monash Centre for Financial Times. Retrieved from https://treasury.gov.au/sites/default/files/2020-07/02-r2019-100554.pdf

Stiglitz, Joseph. (1996). Some lessons from the East Asian miracle. World Bank Research Observer 11(2): 151–178.

Wilkinson, Bryce. (2024). “A Response to Sir Roger Douglas on Budget 2024 Challenges.” The New Zealand Herald.